Key takeaways

-

Connect to the EDS now: All payment service providers and RVMs can test the EPC Directory Service (EDS) in the VoP test environment until August 2025.

-

Stay VoP compliant: From October 2025, SEPA payments must include Verification of Payee checks using data from the EDS.

-

Route VoP requests right: The EDS helps banks find each other through API endpoints and routing data, making secure VoP lookups fast and reliable.

Ready. Set. Go! Go! Go!

The European Payment Council’s (EPC) Directory Service (EDS) has entered its extended pilot phase.

As of Tuesday, 24 June 2025, all eligible payment service providers (PSPs) and Routing and Verification Mechanisms (RVMs) can now access and test the new EDS in the dedicated test environment as part of the Verification of Payee (VoP) scheme. This testing phase will remain open until August 2025.

You have until 5th October 2025 to implement a fully working solution and smooth out any cracks in your VoP service. Connecting to the EDS is an integral part of meeting compliance.

In this article, we’ll explain how the EDS works, what you need to connect to it, and how to make the most of it.

What is the EPC Directory Service?

Let’s start with the service the EDS supports: Verification of Payee.

Say Noel wants to send a payment to Liam. After 5th October 2025, Noel’s bank will need to confirm that Noel has entered Liam’s banking details correctly.

To do so, Noel’s bank will contact Liam’s bank to check. If there’s a difference in the name, account number, or sort code, Noel’s bank will need to tell Noel within 5 seconds of initiating the payment. Noel will get a ‘match’, ‘close match’, or ‘no match’ response. He can then amend, send, or cancel the payment.

This simple step – known as Verification of Payee – helps to reduce authorized push payment fraud. It will be mandatory for SEPA payments under the new Verification of Payee rulebook.

For Noel’s bank to contact Liam’s, it needs to know how. This is where the EDS comes in. The EDS helps banks reach each other for VoP checks. It’s essentially the Yellow Pages for the Verification of Payee scheme. This central platform contains contact and routing details for PSPs so they can exchange VoP requests securely and reliably.

How can I access the EDS?

Banks can access the EPC Directory Service (EDS) through two primary methods: directly via APIs or indirectly through a Routing and Verification Mechanism (RVM).

Despite the name, an RVM is a service, not a tool. It acts as a technical intermediary between the bank and the EDS, routing VoP requests and responses.

Liam and Noel’s banks must share customer data with their RVMs. The RVMs then exchange and verify account information.

Noel’s RVM might connect directly to Liam’s bank (if Liam’s bank has an in-house RVM), or it might route via Liam’s RVM. Either way, the VoP request flows from Noel’s bank to Liam’s bank, where Liam’s RVM checks the account details.

RVMs can be software vendors or PSPs themselves. Some banks may even use TIPS (TARGET Instant Payments Settlement) or intra-group flows. The important thing is that RVMs are registered with the EPC, and most VoP service providers already are.

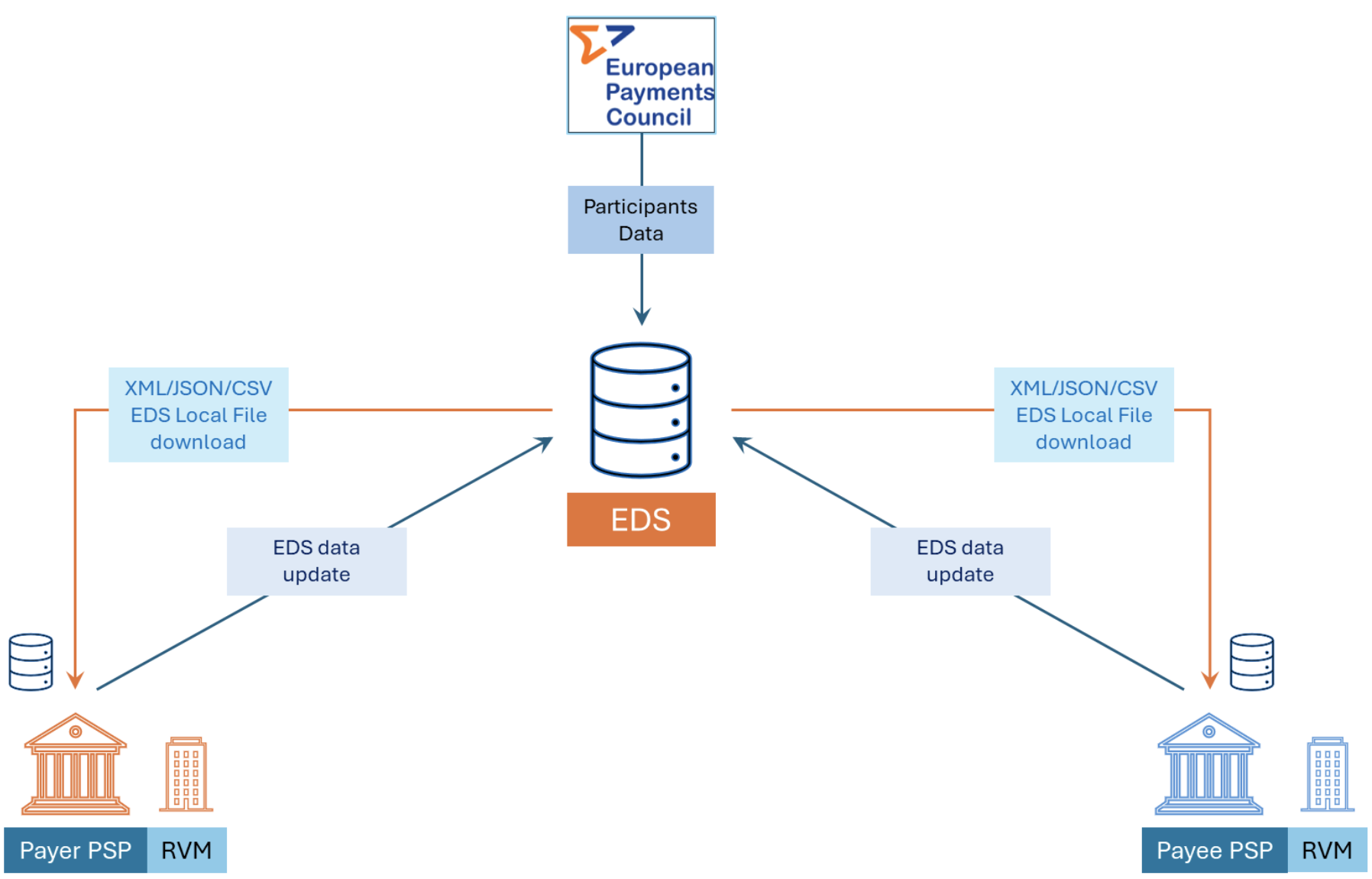

Image: The EDS helps banks contact one another via an RVM using routing data like API endpoints. It stores reachability paths so banks can send VoP requests smoothly and securely. Source: European Payments Council

Getting technical: The EDS Local File

The EDS automatically pulls in data from the EPC Register of Participants. VoP participants and authorised RVMs can view and manage this data via a web portal or API, or download it in a local file.

This local file is updated daily and available in XML, JSON, or CSV formats. It includes:

- Participant details: BICs, account-holding BICs, PSD2 National Authorisation Numbers (NANs)

- Adherence data: schemes joined, joining dates, roles

- API endpoints: URLs, versions, environments (test or production), priorities, validity dates

In practice, a bank will:

- Use the payee’s BIC to look up their endpoint in the EDS file

- Send a VoP request to that address

- Have the payee’s bank verify the requesting bank’s BIC and NAN

- Respond accordingly

What’s Next?

The EPC selected Swift to develop and operate the EDS. The extended pilot phase began on 24 June 2025, and runs until end of August.

Feedback from this phase will help finalize the service design. The full production launch is expected in September, with mandatory implementation required by 9 October 2025.

It’s a huge technical challenge. And time is short.

If you’re struggling with any aspect of the Verification of Payee rulebook, speak to RedCompass Labs. We’re helping some of the biggest banks get ready. We can help you get back on track.

Share this post

Written by

Prashant Joshi

Senior Business Analyst, RedCompass Labs

Pratiksha Pathak

Head of Payments, RedCompass Labs

Resources