“There are two casualties of the ECB decision that really will have an impact. First, project momentum; that’s important of course, especially amongst the tireless evangelists for rich and structured data exchange – how much longer can they keep going before they get hoarse – or bored? The second is even more important; it’s project credibility. Who still believes that the whole banking and payments world will have completed this migration by November 2025?”

–Andrew Muir, Ex-Swift employee and ISO 20022 evangelist

What has been announced?

European Central Bank

On October 20th, a little over a month before the scheduled go-live of the T2-T2S consolidation, the Governing Council of the European Central Bank (ECB) has decided to reschedule the launch of the new real time gross settlement system and its central liquidity management model, T2. The ECB decided to postpone the go-live by four months, from the 21st of November 2022 to the 20th of March 2023.

In the past month, the platform has been plagued by instabilities, software deficiencies, and a test environment that was regularly unavailable. As a result, a considerable number of users would likely have been unable to complete their testing in preparation of the original go-live date. A number of central banks, reportedly including the Deutsche Bundesbank, had subsequently given a negative advice on market readiness, triggering the ECB’s decision to delay the go-live date.

EBA Clearing

It comes as little surprise that EBA Clearing’s EURO1, which has since the start of the migration project been in lockstep with the ECB in terms of format and timeline, responded in a matter of hours:

In line with the modified planning for the ECB T2/T2S Consolidation project, the EURO1 ISO 20022 live migration was moved to March 2023.

Swift

Although rumours were circulating that Swift would respond regarding a potential CBPR+ go-live delay this week following a board meeting, it has decided to postpone a final decision until October 27th:

“Swift has worked extensively with its global community to prepare for the start of the ISO 20022 migration for cross-border payments, and since August, all required capabilities have been deployed and institutions have been able to exchange ISO 20022 messages on an opt-in basis. Additionally, given our strong commitment to operational excellence, we have engaged with our community on a wide range of ‘what ifs’ ahead of the migration to consider the potential client implications of various scenarios. In light of the ECB’s announcement, we will leverage this planning, validate with our global community, and, within one week, either re-confirm or revise the planned start date of the cross-border ISO 20022 migration.”

Will this cause the CBPR+ ISO 20022 migration to be delayed?

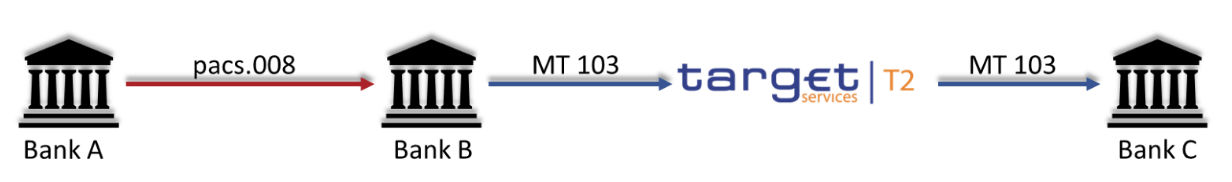

Let us consider the following scenario, operating under the assumption that CBPR+ ISO 20022 messaging has gone live, but T2 remains on MT messaging:

Despite the Payment Market Practice Group’s (PMPG) interoperability guidelines, Bank A could populate its credit transfer with rich data such as Ultimate Debtor, Ultimate Creditor, Category Purpose, Structured Remittance Information, or Related Remittance Information. Such rich data cannot be mapped to fields in an MT message.

Bank B, operating as Bank A’s Euro correspondent, needs to send the payment over the RTGS to Bank C, the beneficiary bank. If the credit transfer contains rich data, it will have no choice but to truncate the payment, being limited by T2’s MT messaging. As a result, it could be in breach of FATF’s recommendation 16, more commonly known as the “Travel Rule.”

Market infrastructures that had intended to migrate at a later date have foreseen mechanisms to transmit such additional data between participants. For instance, The Bank of England foresees that banks must be able to request and retrieve this additional information using MT 199 exchanges between participants. Additionally, it requires its participants to adhere to strict mapping rules, allowing receiving banks to unequivocally identify instances of truncation.

The Fedwire Funds service has taken a different approach, applying a market practice in which banks can map ISO 20022 overflow data to tag {8200} in its proprietary format.

In short, market infrastructures and their participants have prepared for these overflow use cases that were anticipated. This was, however, not the case for T2, as the original go-live was scheduled to coincide with the CBPR+ ISO 20022 go-live, rendering this use case moot.

Deploying a guidance, ensuring correspondent banks are capable of mapping CBPR+ ISO to T2 MT messages conformant with these guidelines, and testing it, all within a month of the anticipated go-live of ISO 20022, would put the Eurosystem’s members in a particularly challenging predicament.

Consequently, we would expect Swift to delay the CBPR+ go-live to once again coincide with T2. Trickle-down effects of such a decision on other market infrastructures, such as Canada’s Lynx system that had anticipated to go live with ISO 20022 messaging in November 2022, would need to be weighed against the impacts on the Eurosystem’s members. Australia’s AusPayNet is currently consulting its participants to see what their options are as far as moving forward with a November or March go-live. It is not entirely unlikely that these RTGS would in turn push back their go-lives to align with CBPR+, leading to a an unfortunate – but inevitable – domino effect of ISO delays.

What should banks do with this information?

- To start with the obvious, Eurosystem member banks should ensure that they foresee the capacity to release on the revised date, March 20th 2023.

- Any Eurosystem member banks that have not yet completed their testing should continue to progress in order to achieve a timely readiness.

- Keep close communications with your correspondent banks as well as the market infrastructures that you participate in in order to ensure that you remain appraised of any changes in timelines, formats, or business processes.

- Above all, make use of these additional four months to fix any remaining bugs and inefficiencies, and to build on strengthening ISO 20022 knowledge within impacted departments.

To add on to the pointed comments of Andrew Muir mentioned above, the first domino of ISO 20022 delays has been knocked over by the ECB, and in the coming days we will learn the full impact on clearing systems across the globe. Banks will likely have an additional four months grace period, which they must use to their best advantage, in order to ensure that when they finally do go live on ISO 20022, they do so with confidence.

And…. Let us not forget: difficult roads lead to beautiful destinations!

Share this post

Written by

RedCompass Labs

Resources