Key Takeaways

- Stablecoin momentum is growing. New rules in the US, EU, and Canada are legitimizing stablecoins. The market is moving faster every day.

- Integration is the challenge: Banks and payment providers are experimenting, but connecting stablecoins with legacy systems is still complex and costly.

- The near future is hybrid: Stablecoins will complement, not replace, existing rails. Success will depend on trust, regulation, and interoperability.

Stablecoins are gaining serious momentum. Not a day goes by without some sort of news on the topic (this article included). Why?

Well, because if you’re Visa, building rails into hard-to-reach markets, stablecoins could have a big impact. And if you’re Wise, moving money where banks can’t, the same is true.

Stablecoins offer near-instant, always-on settlement over global infrastructure, without depending on local banks or legacy correspondent networks. That is a big deal. There is a need to play in this space. Particularly as more countries and customers begin to access stablecoins.

Right now, most stablecoin transfers still happen outside regulated payment rails, which means banks can only move limited volumes through them.

But that is beginning to change. The US, the EU, and now Canada have introduced frameworks to bring stablecoins into the mainstream (though numbers are still tiny compared to the billions and trillions flowing through Europe’s established networks like EBA Euro 1 and TARGET2, every day). The market is evolving rapidly and shows no signs of slowing down.

So, if you’re a bank, you may be wondering how seriously you should consider stablecoins. And how do you even begin?

A house of cards

Let’s start with what a stablecoin is: a digital token designed to hold a steady value, usually by being pegged 1:1 to a fiat currency like the US dollar or euro.

In theory, they offer the speed and programmability of crypto with the stability of traditional money. But to understand what it would take for stablecoins to matter at scale, you have to zoom out.

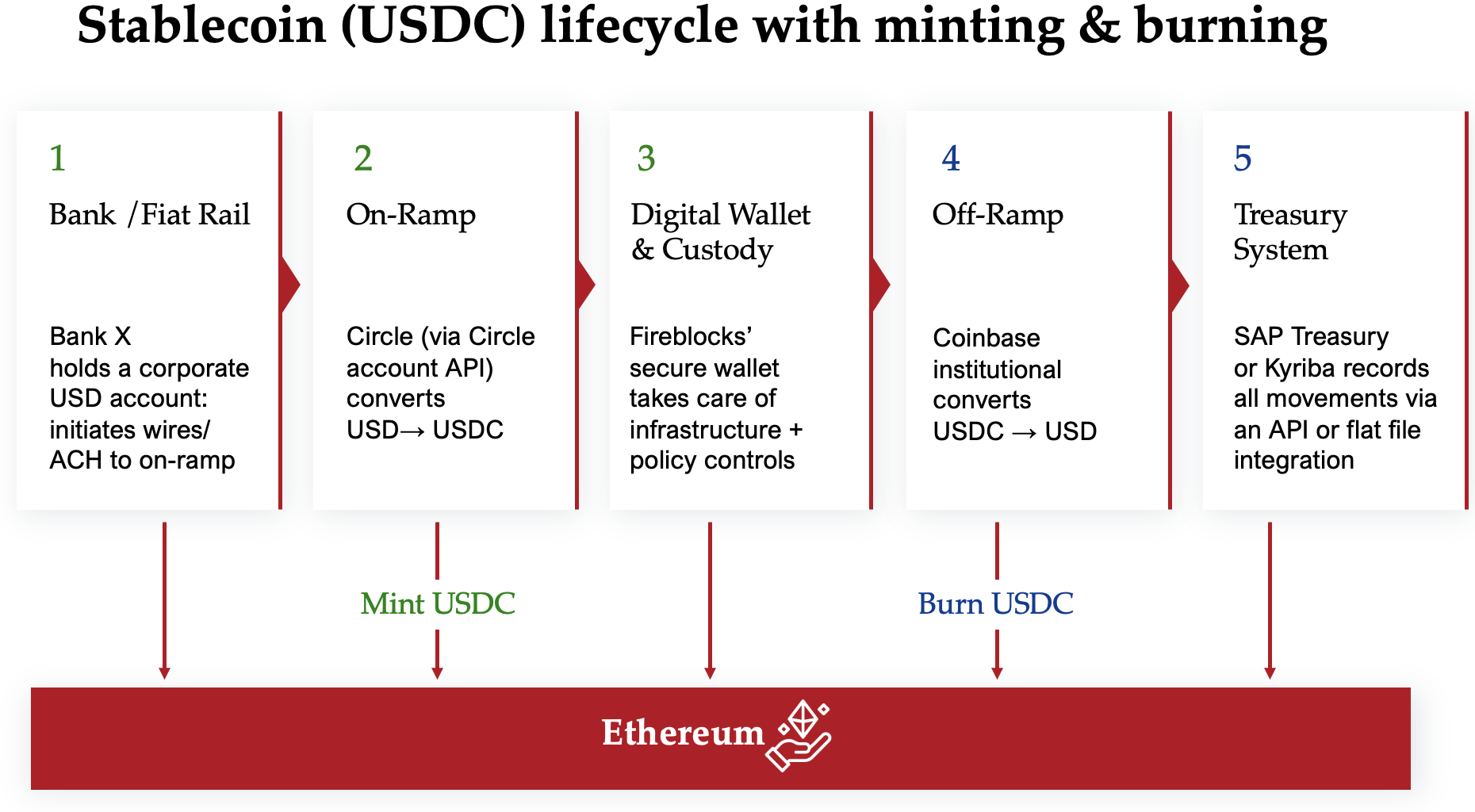

- Bank/fiat rail: 1 dollar = 1 stablecoin

- On-ramp: Minting USDC- Circle receives USD fiat and issues/mints USDC on-chain

- Digital wallet & custody: The movement of a stablecoin is represented in the blockchain settlement layer here. Ethereum is the blockchain & Fireblocks is the wallet infrastructure. Transfers between wallets are executed as blockchain transactions.

- Off-ramp: Burning USDC: Coinbase (or authorized off-ramp) redeems/burns USDC for USD, and converted USD fiat is sent via ACH/wire back to the end user’s account.

- Compliance, Fraud & Risk Controls: Continuous compliance checks, fraud detection, and risk controls must be embedded across every stage

- Treasury: Ensures real-time liquidity management, enforces approval workflows, and maintains robust control frameworks for all stablecoin movements

The financial system is more than just rails, message formats, arrival times, or fees. It’s built on interdependence and trust — and that takes time to build.

In 1995, Barings Bank collapsed after a rogue trader’s losses in Singapore triggered exposures across its counterparties. The event was small compared to today’s global institutions. But it exposed how interlinked and fragile the system could be.

Then, in the 2008 financial crisis, liquidity froze overnight because banks no longer trusted each other with excess cash. The slowdown eventually led to the near-collapse of the system. Lehman Brothers was allowed to fail — a decision that proved catastrophic. Afterward, governments stepped in to prop up banks, restoring confidence and restarting the flow of money. If one part stops moving, the whole thing can collapse.

The point is this: Money depends on continuous motion — a circular flow that relies on funds constantly moving in and out. When that flow slows, as it did with Barings in 1995 and again during the 2008 credit crunch, trust evaporates, liquidity dries up, and the whole system feels it.

That’s why we have networks like EBA’s Euro 1, which nets transactions in batches several times a day so settlement is same-day, if not nearly-instant. Euro 1 is designed to prevent contagion. If one bank in that community fails, all the others assume its liabilities. That collective guarantee absorbs the shock rather than amplifying it. It stops the domino effect before it begins.

Any stablecoin ecosystem that wants to be more than a side-show will need equivalent mechanisms for managing failure and contagion. Not just faster rails.

Stability is key

So, when you think about stablecoins, you have to see them as part of a much bigger picture. The financial system isn’t just the pipes. It’s about how risk, trust, and interconnection are managed.

Adoption, therefore, depends on the broader ecosystem. That includes issuers, payment networks, merchants, regulators, and end customers.

To function effectively, this ecosystem must deliver three things:

- Trust and liquidity: Stablecoins must be redeemable at par and widely accepted. That requires credible issuers, transparent reserves, and robust risk management.

- Connectivity: Banks, fintechs, and payment providers must be able to transact seamlessly across chains and jurisdictions.

- Participation: Customers, merchants, and corporate treasuries need clear incentives to use digital currencies rather than the traditional rails that already work.

The ecosystem’s success will hinge on its ability to balance innovation and interoperability. It must ensure new rails don’t fracture the trust that underpins money itself. That includes combating financial crime and money laundering (but that’s for another article).

Regulatory clarity?

Now, the GENIUS Act (Guiding and Enabling National Innovation for U.S. Stablecoins Act) is a step toward legitimacy. In July 2025, the U.S., the world’s largest financial market, passed the first federal law setting clear rules for issuing and using stablecoins. It defines stablecoins as digital assets used for payment or settlement and redeemable for a fixed monetary amount (typically 1 USD = 1 coin).

There are now requirements for who can issue them, full-reserve backing, and AML / sanctions compliance, along with consumer protection and insolvency rules. It’s a turning point.

Yet critics argue it still leaves gaps in oversight and systemic assurance, particularly around how private stablecoins interact with existing regulated infrastructure.

Moving money along rails that aren’t insured or fully regulated is a risk. Regulated systems guarantee safety and recourse if something goes wrong.

Some people might not care. They’re comfortable holding funds in a private stablecoin wallet. But most customers trust banks precisely because of regulation.

And elsewhere

So where are we globally? Well, approaches to stablecoin regulation vary widely. Each region has different priorities around innovation, consumer protection, and monetary sovereignty.

- United States: The GENIUS Act (2025), as we’ve discussed, establishes the first federal framework for stablecoins. It provides regulatory clarity but leaves open questions about systemic risk and private issuance.

- European Union: The MiCA (Markets in Crypto-Assets Regulation) framework sets out detailed oversight for issuers, requiring authorization, transparency, and full redemption guarantees. It emphasizes stability and consumer protection.

- United Kingdom: The UK is taking a phased approach. It has started by bringing stablecoins under existing e-money regulations and testing broader models in a Digital Securities Sandbox to preserve London’s competitiveness.

- Canada: In November 2025, the federal budget unveiled Canada’s first national stablecoin framework. This defines who can issue coins. And that will require licensing, high-quality reserve assets, redemption rights, and mandatory audits — a milestone in digital asset policy for North America.

- Emerging Markets: Elsewhere, countries such as Brazil, Nigeria, and Singapore are exploring stablecoins to improve financial inclusion and cross-border payments. The goal is to extend access to digital finance in economies where banking infrastructure remains limited.

Regional efforts point to a global shift. But the market is fragmented. There will be and continue to be big differences in timelines, standards, and oversight.

Integrating stablecoins

That said, the policy foundations are arguably in place. The industry is starting to consider how stablecoins might actually work.

Citibank has been testing tokenized deposits and settlement coins within its Citi Token Services platform, allowing clients to transfer value across Citi’s global network instantly and securely — using blockchain for efficiency, but under full regulatory oversight. JPMorgan’s JPM Coin, BNY Mellon’s digital-asset pilots, and Mastercard’s Multi-Token Network point in the same direction: combining blockchain’s agility with traditional trust.

Everyone needs to experiment in this space. Build capability. Understand the models. But how?

Stablecoins aren’t intended to replace cards, instant payments, or traditional clearing systems. They’re complementary. So you have to think: how do I balance stablecoins with my other offerings? Big banks have the scale and resources to justify a stablecoin project. Do I?

It’s not about asking “Should we issue a coin?” but rather, “How do we position ourselves so that when stablecoins are the best tool, we can use them?”

To answer that, you must first determine how they fit within your current architecture.

Existing payment systems must connect with blockchain networks, support tokenisation, and manage smart-contract-based settlements. Interoperability with legacy infrastructure is a high hurdle.

Reconciliation, liquidity management, compliance, and risk frameworks all require redesign to accommodate the speed and transparency of digital tokens.

And all of this demands capital and talent. You need people who understand both blockchain and the existing payments stack. Do you have the resource?

It’s a fundamental re-engineering of value flow. Integration will be the defining challenge.

What does true readiness look like?

Much of the public conversation around stablecoins focuses on why they matter, but far fewer voices address what true readiness actually looks like.

Genuine readiness spans four interconnected dimensions: technology, operations, people, and regulation. Technologically, institutions must upgrade systems for blockchain compatibility, security, and scalability. Operationally, they need to redesign processes for compliance, settlement, and reconciliation. The people dimension involves developing or acquiring talent fluent in both financial regulation and distributed ledger technology, while regulatory and risk readiness requires robust governance aligned with emerging global standards.

Beyond these, you’ve to consider pricing models, liquidity structures, and treasury implications. Stablecoins will reshape liquidity, capital, and balance-sheet behavior across your entire organization. Before entering this space, each bank must ask: do we have the architecture, the talent, and the appetite to operate in a tokenized economy?

What to ask?

The future will likely be a hybrid world where distributed ledgers, stablecoins, and traditional systems coexist and complement one another.

The questions to ask are:

- How would I, a bank, actually integrate stablecoins into my operational payment framework?

- How would it fit within your payments platform— the kind of infrastructure that connects different rails and systems?

- Are stablecoins really central to what matters most in payments modernization?

You can run stablecoin pilots or small proof-of-concept tests, but integrating them into a regulated banking core is another matter entirely.

Of course, they do matter in areas like interoperability — the ability for one payment system to communicate seamlessly with another. Stablecoins also raise important possibilities for financial inclusion, since in countries without established payment rails, they could give people access to digital finance for the first time. But there is some time to go.

Trust as the bedrock

Trust is the foundation of money and banking. Without it, the system doesn’t function.

In the near term, some flows will stay on existing rails; others will migrate to stablecoins — particularly large-value or cross-border treasury flows where the cost and latency of legacy systems are visible.

Over the next 2–3 years, stablecoins will become regulated, integrated, and useful, but not foundational or dominant. They’ll sit on top of — not replace — the existing monetary and payments infrastructure.

But until stablecoins establish the same level of trust, regulation, and operational assurance as established networks, they’ll remain a complement, not a replacement.

The opportunity is enormous. But so is the rate of change in the market.

We see potential in stablecoins. We believe every bank should be experimenting with them thoughtfully. But you must ask the critical questions: What does modernization mean if trust, regulation, and shared accountability don’t evolve with it?

Exploring stablecoins?

Let us know your thoughts by emailing [email protected]. We’ll pass them on to our experts.

Share this post

Written by

Neha Dasani

Payments Strategy and Delivery Lead, RedCompass Labs

Divya Tak

Senior Business Analyst, RedCompass Labs

David Patrick

Head of Payments Strategy, RedCompass Labs