What is hybrid intelligence?

Hybrid Intelligence is the fusion of human expertise and artificial intelligence (AI). It combines the strengths of both to achieve outcomes that neither could accomplish alone.

Our Payments AI Agents combine expert-trained models with human-in-the-loop expertise and governance. They understand schemes and standards, and work with expert teams to generate program artifacts, validate platform changes, and guide onboarding—with citations, auditability, and bank-grade controls.

Closing the Expertise Gap

Payments project teams are under pressure: complex schemes, tight regulatory timelines, fewer experts. Our expert agents fill these gaps.

Right first time

Payments-tuned, detailed project artefacts, scheme, and system insights with cited sources.

Speed with substance

Compress months into weeks without sacrificing precision and certainty.

Priceless expert input

Spot the hidden risks and support your teams with the expertise to make the critical decisions.

Use across payments technology teams

The promise of AI is lower costs and higher productivity per person. Add payments experts in the loop and models trained on their knowledge, and it really can happen.

Product & Delivery

Remove ambiguity early; standardise interpretation; compress timelines.

Technology

Implementation-ready guidance you can map to configs, mappings, and tests.

Compliance/Risk

Transparent citations, audit logs, and full human expert review.

The Payments Modernization Flywheel

Start with faster, safer, cheaper – end with scalability, automation, transformation.

Scale

delivery with the Payments Expert Analyst Agent programme artefacts and test packs on tap.

Clarify

everything with the Scheme Expert Agent. No ambiguity, fully cited.

Implement

and Upgrade with the Payments Platform Agent. Close the vendor – client gaps; accelerate and improve analysis, development, and QA.

Onboard

to new rails and schemes fast with the Scheme Onboarding Agent. Diagnose, gap, and plan.

Try it now with AnalystAccelerator

Experience the accuracy, speed, and explainability—no install required.

Ask your payments queries (read-only Q&A) with inline citations

Generate lite, watermarked artefact snippets (BRD/test cases)

See the “Why this answer?” panel and source viewer

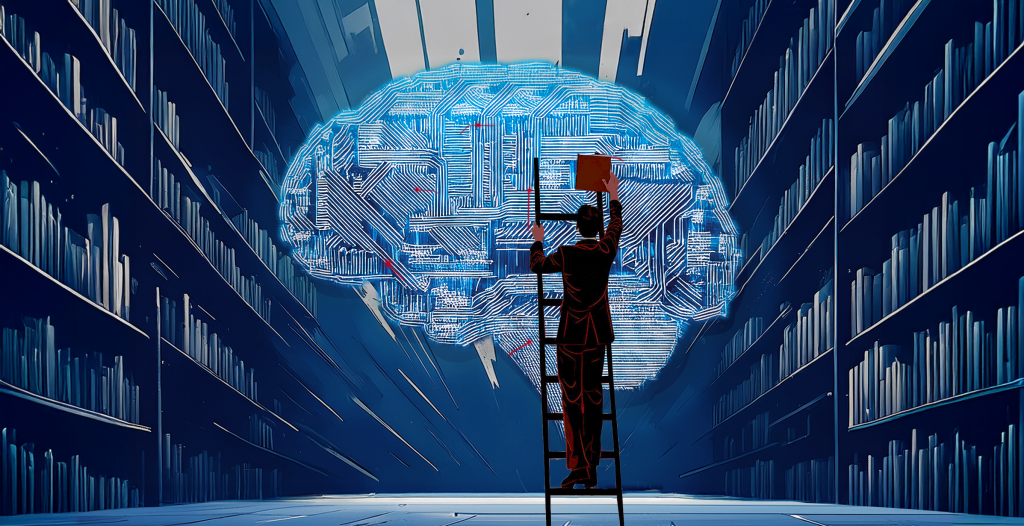

Research

Are banks ready for AI?

In a survey of over 200 payments industry leaders, we learned how banks see Applied AI as a tool to help them to keep up with the pace of change.

Our research reveals how banks are already using AI in payments modernization and their plans for the future.

54%

of banks plan to leverage AI for payments modernization

62%

are actively or aggressively exploring AI technology

49:51

banks favor a balanced approach to AI with 49% human and 51% AI involvement

Security, Data & Operations—by design

Identity & access

Microsoft SSO, RBAC, immutable audit logs.

Isolation

Client-segregated tenancy; encryption in transit and at rest.

Inference-only

No training on your data; strict minimisation (no PII (personally identifiable information) required).

Governance

Expert-in-the-loop review before deliverables; full traceability with citations.

Three ways to run an agent

Secure Web Portal (SSO)

Named users, RBAC, full audit.

API Integration

Call the agents from your existing AI interface/orchestration.

Client -Hosted Deployment

Run agents inside your cloud tenancy under your identity, network, and logging policies.

Case study

Fast-Tracking Project Delivery for a Tier 1 Bank

AnalystAccelerator is already enabling banks to deliver the future of payments today.

Working with a tier-one bank, AnalystAccelerator.ai delivered a large and critical project in a single day, something that traditionally would have taken three weeks of detailed analysis.

47

detailed and accurate business requirements generated automatically within 45 minutes.

2 hours

of human review before the documents were approved internally.

1 day

to publish. Once approved, the final documentation was distributed in the correct format.